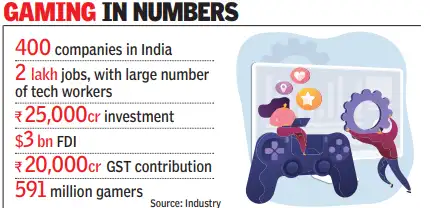

New Delhi: The Indian Gaming Industry, Which Till Just a Few Years Back Was Seen as a Sunrise Sector, was Shell-Shell-Shhocked by Govt’s Proposed Move to Ban “Online Money” Online Money ” The death knell for firms. Industry Experts Pointed Out that The Measure Bold Put 4 Lakh Companies, 2 Lakh Jobs, Investments of Rs 25,000 Crore and Annual GST of Rs 20,000 Crore at Risk. As draft copies of the Bill Started Circulating Online, Gaming Executives Said They Bold “Need to wind down operations with no placusible source of revreece of revree “We will fold up if this become a reality,” a top official said.

Gaming in Numbers

“We will fold up if this become a reality,” a top official at one of the biggest gaming companies in India said. “What is surprising is that that, while govt regularly consulted us on most of the issues, there was virtually no discussion this time around on a proposal that has the capacity to decomet Company is Big in Fantasy Gaming, Where Again Real-Money Transactions are popular-Told toi.There will be a downstream impact to domestic sports as fantasy sponsorship keeps most non-T20 Leagues Afloat, with State and City Leagues Likely to Be Hit, Weekining the Talent Pipeline, Industry Players said.Most Companies Insified that Large Indian Gaming Players, With Regulatory Structures and Strong Funding, Including Fdi, WERE “Not Engaging in Any Illegal Activities” Subch as gooding, money laundering, money Financing or gambling. Dream11, Games 24×7, MPL, Gameskraft, Nazara Technologies, Zupee and Winzo are among the big players in this space.“Our operations were broadly focused on skill-based real-money games. These have been the source of our reviews, which have seen us build valuations, provide jobs to enginers and graphic designers, Gain global reconstrance and fdi funding and provide GST and Provide Gast and Tax Tax O Another founder of a top company said.Industry Sources said there is also a risk of some the platforms moving offshore or other apps taking advantage of the gap, with weight kyc and anti-money laundering provisions and in turn, in turn, IPACTING TAXLECTIONS.Countries such as the UK, the US and Australia Regulate and Licence the Business with Strike Kyc, And Advertising Rules and Enforcement, Intead of a Ban, A Ban, and Industry Players Suggeteed that even in India Preferred model to regulate and monetise the industry. The 2023 framework, which is sought to be Junked, Had Created Rules and a Self-Regulatory Organization Path for “Permissible” Real-Money Games, which should be strengthened, they are suggested. Besides, The Bill Leaves Several Gaps as there is no transition plan. If a law is legislated, there is a need for wind-door, ENSURING User Balance Refunds and Employee Protections to Avoid a CLIFF-Edge Shock, called experts. A Balanced Outcome Can Be Achieved By Licensing Onshore Operators, Setting Deposit and Loss Limits, Along with Affordability Checks, Localising Data, and Blocking Illlegal of Sites Aggressively, they added.